Financial stress is taking a heavy toll on South Africans, with about 54% unable to make their money stretch to month-end. It is impacting their own mental health, along with constant worry about the health of their loved ones.

These findings in a recent Sanlam survey conducted by Ova to You, highlights the imperative to focus on factors within our control – in particular the need to make the best possible financial decisions in very trying circumstances. The study was conducted amongst 1200 South Africans as part of Sanlam’s campaign – Letters to My Pre-Covid-19 Self and it asks people to reflect on what they wish they’d known or done prior to the pandemic.

Farzana Botha, Segment Solutions Manager at Sanlam Savings, says, “We’ve all gone through this major life event together and it’s changed many of us in profound ways. We can’t underestimate the toll it’s taken on our mental health. We’re likely to keep seeing the impact of this for years to come. The survey showed that above anything else, most people wish their former selves had saved more. It really brought home the impact money has had as a stressor on mental wellbeing.”

Here are some of the key findings from the survey, showing how South Africans are feeling and what they wish they could write to their pre-pandemic selves:

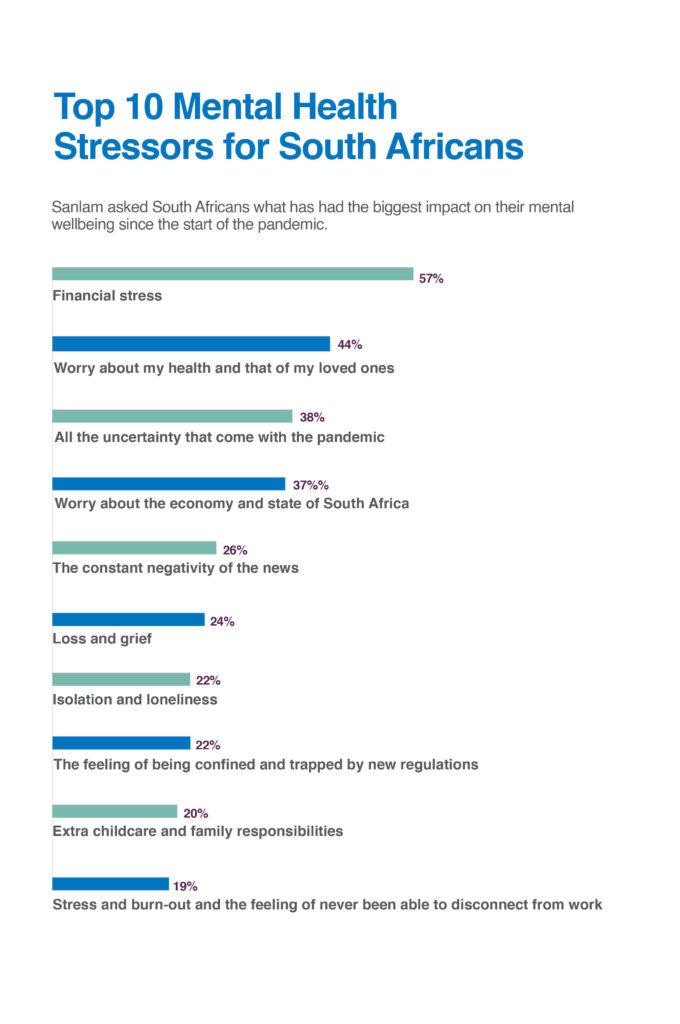

- Financial stress has reportedly had the most major impact on people’s mental wellbeing: A whopping 57% of participants cited financial stress as having a huge effect on mental wellbeing. This was followed by worry about their own and loved ones’ health (44%), and all the uncertainty brought about by the pandemic (38%).

- Financial stress hit young people the hardest: Those aged 18-24 were most mentally impacted by financial stress – and younger women were the hardest hit of all.

- Older people more concerned about the state of the nation: Interestingly, older individuals were more worried about the economy and state of South Africa. They were also more impacted by the negativity of the news.

- Loss and grief impacted all ages, equally: 24% of people cited loss and grief as having a mental impact; 22% said isolation and loneliness.

- Childcare and family stresses most felt by women: The 20% of people who listed childcare and family responsibilities as having a mental toll were, predictably, less likely to be male and usually more likely to be aged between 25 and 39. In a country where 41.8% of households are female headed (Stats SA: 2019) and close to 70% of black children live without biological fathers at home, this is unsurprising and shows the severe stress many women are feeling.

It was clear that the pandemic made many rethink their physical and mental wellbeing. During Covid-19:

- 21% of people went on prescription medication to help with stress and anxiety

- 21% invested in online and physical exercise options, like a gym membership or yoga

- 12% sought counselling or therapy

- Others went on health supplements and turned to natural remedies, along with meditation and mindfulness

About 35% of respondents said they always make time for self-care (self-care was undefined). Most of these were younger men with an income of less than R10 000 a month. Close to 59% said they make time when they can (likely to be older: 40+ years), and 6.7% said they never make time.

In terms of what they’d write to their pre-pandemic selves about what they’ve learned about wellbeing, some of the responses were:

“That everyone is susceptible to any manner of mental health issues, especially anxiety and depression. I’ve learned to seek psychological assistance in the form of therapy to assist me in managing anxiety in these trying times.” – Male, 30-39 years old, Gauteng, HHI R30k+

“I’ve learned that I must start taking my mental health seriously and avoid anything that could affect it.” – Female, 18-24 years old, North West, HHI Less than R10k

Overall, most people wanted to tell their pre-Covid-19 selves to ‘take time to enjoy the simple things in life and the moments with loved ones’, as well as to ‘manage your finances better and start an emergency fund’.

Botha says, “We thank everyone who participated in the survey for being so open and honest. It takes tremendous courage to be so vulnerable. It’s clear many of us are going through so much right now and we need to create a culture where people feel comfortable talking about what they’re experiencing.

“It’s also obvious that financial stress is having a huge toll. Sanlam is committed to helping people live with confidence. As part of this, we aspire to empower South Africans to have the knowledge necessary to go after their goals and make smart money decisions to live their best lives. We are here to help you make the right decisions for yourself and your family.

“We have many advisers and tools on hand to help you come up with an achievable, holistic plan. We’re here for you. It’s never too late to turn a situation around. You’re not alone.”

For further information on Sanlam, please visit us at www.sanlam.com

- THE STATE OF SOUTH AFRICANS’ MENTAL HEALTH- And what we wish our pre-pandemic selves had known - November 18, 2021

- Saving Can Be Child’s Play - November 9, 2021

- IN TOUGH TIMES, IT’S MORE IMPORTANT TO TALK MONEY THAN EVER - October 7, 2021